The Layer-1 Rotation Trade

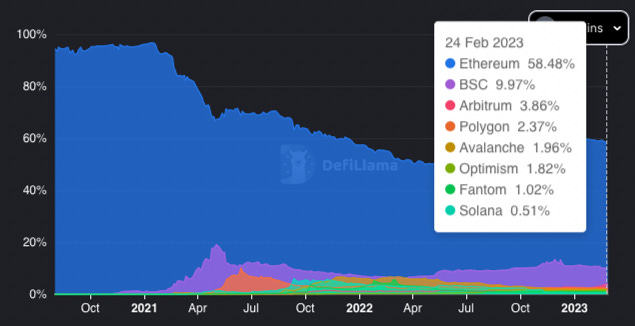

The 2020/21 crypto market cycle taught us a substantial amount about the behaviour of new market entrants and their inclination to pursue a low transaction fee environment irrespective of the underlying networks decentralisation. Ethereum’s underlying layer-1 blockspace proved to be insufficient to accommodate the influx of new market participants eager to speculate. The scarcity of blockspace resulted the persistent elevation of gas fees which price out the average market participant from speculative on-chain activity. This was the primary reason for the flight of on-chain speculation and TVL from the Ethereum blockchain to other networks such as Binance Smart Chain (BSC), Solana and Avalanche.

Beyond the speculation aspect of liquidity migration, it is important to understand that protocol level innovation requires engineers to create new networks with new validator sets to validate and maintain that blockchain’s state. Protocol level innovation will continue to exist given debates around consensus algorithms, execution environments and chain parameters with respect to throughput/node hardware requirements and finality periods. Given the above, we believe that the most important infrastructure in the multi-chain paradigm is a bridge or more broadly, a generalised messaging system that facilitates liquidity migration and arbitrary messaging between a source chain and destination chain. This includes connecting both EVM-compatible and non EVM-compatible chains. The Interoperability vertical is one of the most challenging to understand given the heavy focus on a security-latency trade-off that has resulted in some of the largest exploits we have seen in the cryptocurrency asset class to date.

Below we will outline the importance of generalised messaging systems and how there exists a larger total addressable market than the migration of liquidity, the importance of bridging given the rise of optimistic rollups and their 7 day finality period and emerging generalised messaging systems such as Synapse Protocol and LayerZero.

TCP/IP and Generalised Messaging Systems

TCP/IP is a set of fundamental protocols that define how data is transmitted between network devices over the Internet. The Transmission Control Protocol (TCP) defines that data sent across the Internet should be transmitted in the form of packets and properly addressed, routed and received. The TCP protocol set the foundation for device interoperability using the Internet protocol allowing the seamless exchange of data across the planet at the speed of light. It’s arguably the single most important protocol that underpins the interconnected modern world.

Similarly, the protocols that underpin the new application layer of the internet commonly referred to as ‘Web3’ require a protocol or a set of protocols that define how these blockchain networks communicate with one another. The permissionless exchange of information was the defining factor of TCP/IP. Equally, blockchains require the same degree of interoperability when it comes to the permissionless flow of assets and more broadly messaging between DApp instances on different chains. Generalised messaging systems are the protocols that enable inter-network communication and are set to be the most important infrastructure given continued protocol layer development and Ethereum’s rollup roadmap with segregated transaction execution environments. A question that we often reflect on when thinking about the Interoperability Thesis:

If the TCP/IP protocol suite had a token then how would the market go about finding a valuation for it given its monumental importance in the modern world? Similar logic can be applied to the protocols that underpin the multi-chain paradigm of segregated blockchain networks.

The Interoperability Thesis

There are three pillars that underpin the Interoperability thesis. These pillars are axiomatic statements which we are certain are true to the highest possible degree. The thesis is comprised of the following:

Protocol layer innovation requires the creation of new networks. This remains the fundamental axiom that underpins the multi-chain paradigm.

The Ethereum rollup-centric roadmap will result in multiple execution environments and the fragmentation of liquidity that currently resides on the layer-1. Optimistic rollups are the most dominant and immediately scalable solution but have a 7 day finality period for the withdrawal of assets. Therefore, there will be a large demand for bridging infrastructure that can bypass the imposed finality period.

DApps seek to go multi-chain to capture a larger user base and increase their protocol revenue. The current multi-chain strategy involves multiple protocol instances across new chains which increases bandwidth required for protocol maintenance, increased attack vectors from the new execution environment/codebase and fragmented liquidity which negatively impacts user experience.

To summarise, the Interoperability thesis is an intersection of the tautological fact that new networks will continue to be created when protocol level innovation is required and the emerging layer-2 thesis which is the primary route of scaling the Ethereum blockchain. Both L1s and L2s need bridges to facilitate the permissionless flow of liquidity from the source chain to the destination chain and vice versa. As discussed in the previous layer-2 thesis, we view optimistic rollups (ORUs) as the most immediately scalable L2 solution with the coming EIP-4844 upgrade. As liquidity and on-chain activity migrate to an ORU, then bridges are the primary infrastructure to bypass the 7 day finality period for withdrawals. We also expect that L2s will become the primary on-boarding layer for the next wave of adoption. Lastly, the developer experience of multi-chain deployments is cumbersome and met with many technical problems which can be more effectively solved with a generalised messaging layer for cross-chain communication. Based on the above, we view generalised messaging protocols and their emerging application layer as one of the most exciting emerging verticals.

An Introduction to Cross-Chain Messaging

The Life Cycle of a Cross-Chain Message

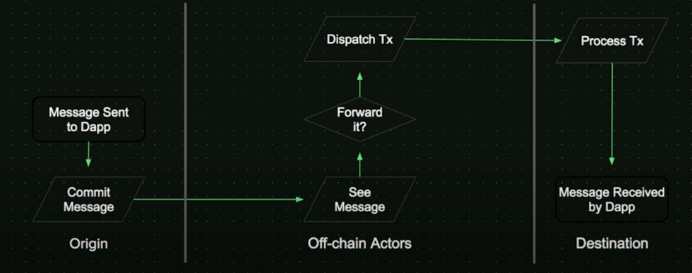

In order to understand generalised messaging systems we must be able to visualise how messages or arbitrary data is propagated from the source chain to the destination chain and vice versa. Therefore, lets outline the fundamentals steps using an example:

Alice interacts with a DApp on the source chain executing an action.

This message is broadcasted to the off-chain actors called Watchers who then verify its validity.

The message is then further propagated to the destination chain by the Watchers via a dispatch transaction.

The destination chain then receives and processes the transaction from the source chain.

Alice’s desired action is executed and finalised on the destination chain.

The Lock and Mint Model

The lock and mint bridging model is a common bridging model and has been employed by Synapse Protocol for xAssets and Frax Finance for their ‘Ferry Mechanism’ of cross-chain FRAX/FXS. The model is as follows:

User will deposit x amount of token into a smart contract on the destination chain thereby locking the source chain asset.

A cross-chain message is sent from the source chain to the destination notifying that x amounts of the token has been locked.

A smart contract on the destination chain proceeds to mint the equivalent amount of the token on the destination chain.

This model is also the foundation of the new LayerZero Omnichain Fungible Token standard in which the total supply remains constant but the amount of the token on a connected chain remains variable/flexible allowing token holders to seamlessly bridge their token holdings from each chain.

Native Asset Bridging via a Cross-Chain AMM

Instead of utilising the lock and mint model which requires locking assets on the source chain and minting the corresponding asset on the destination chain. Actual liquidity of native assets can be utilised in an AMM model in which liquidity providers would allocate liquidity on both the source and destination chain and capture swap fees and token inflation rewards as the form of yield. This is a common bridging model that has been employed both by Synapse protocol and Stargate Finance which has resulted in billions of cross-chain asset swap volume.

Bridges and their Security Models

Bridges and generalised messaging systems are, in our opinion, the single most important infrastructure in a multi-chain world. Therefore, they must command the highest possible degrees of security to prevent hackers from exploiting the system and compromising huge sums of assets. This has already been demonstrated by the fact that bridging exploits accounted for ~50% of the total value lost in all DeFi exploits resulting in ~$2.5B in exploited assets.

Compromised Private Keys

Harmony: The Harmony Horizon bridge was exploited for more than $100m which utilised a 2–5 validator scheme. Meaning only 2 of 5 actors needed to be compromised within the multi-sig scheme. This is commonly referred to the M-N model in which M participants are needed to be compromised for an exploit to occur. The private keys of the two multi-sig accounts were encrypted in a key management service. The hacker managed to obtain the encrypted private keys and decrypt them to exploit the bridge.

Ronin: The Ronin network hack was once again a result of private keys being compromised showing the fatal flaws of multi-signature scheme bridge security models which should be abandoned entirely. The attacker gained access to 4 private keys controlled by Sky Mavis executives and a third-party Axie DAO validator which allowed the signature of a malicious transaction resulting in 173.6k ETH and 25.5m USDC being stolen.

Smart Contract Exploits

Wormhole: The Wormhole bridge connecting Ethereum and Solana was hacked for 120k ETH via a smart contract vulnerability. The attacker utilised the complete_wrapped function initiating a validator action approval which was signed and executed. Essentially the attack vector was a forged signature whilst resulted in >$300m exploit.

Nomad: Nomad’s exploit wasn’t a result of their underlying messaging security but a smart contract vulnerability where the trusted root value was initialised to 0x00. This resulted in all messages being automatically proven and as a result $190m was drained from the Nomad bridge.

Summary

The History of bridge exploits shows us that a bridges security model is of the utmost importance in order to prevent the draining of bridge assets. Highly trusted setups such as the M-N multi-sig has been shown to be highly comprisable. The M-N model was aiming for latency minimisation which is the reason why the bridges were exploited. Additionally, we can see even with solid security models as with Nomad exploits can still occur within the codebase. On the contrary which ever protocol solves the security-latency tradeoff with a battle tested codebase will become immensely valuable.

Synapse Protocol and Optimistic Message Verification

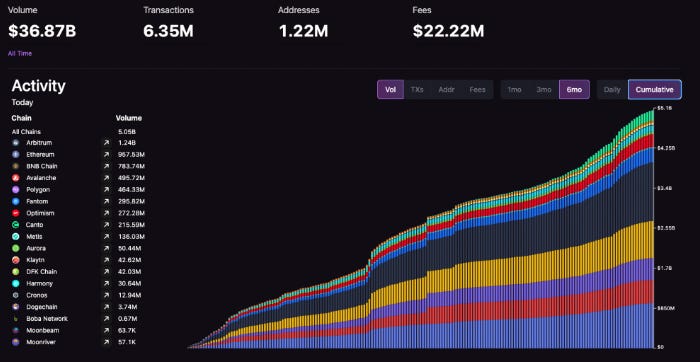

Synapse protocol in its current state is a cross-chain AMM deployed on 15+ EVM compatible blockchains that offers bridging of both native cross-chain assets such as stablecoins in their stableswap pools and wrapped assets via canonical token bridging. Synapse protocol has achieved a clear product-market fit with its friendly interface and deep cross-chain liquidity facilitating over $36B in cumulative volume for 1.2m individual addresses as shown below.

However, in its current form Synapse protocol is a simple liquidity layer that facilitates the bridging of assets via cross-chain swaps in their AMM instances. The recently proposed Synapse Chain architecture revealed a much deeper ambition of transitioning to a generalised messaging system which could be the foundation of the next set of native cross-chain applications.

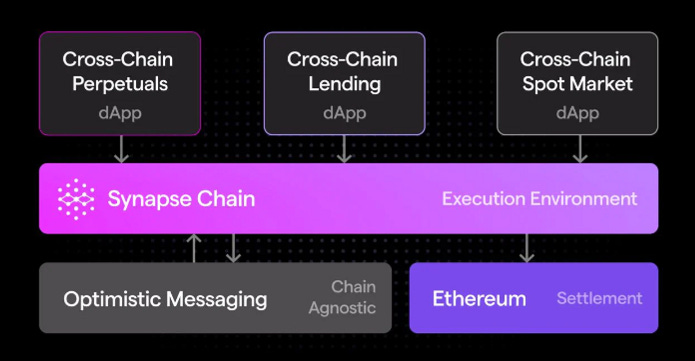

Synapse Chain

Synapse Chain is an Ethereum based optimistic rollup (Optimism layer-2 fork) that provides a single execution environment for multi-chain DApps by leveraging their native optimistic message verification system for validating cross-chain messages. Synapse chain derives its security from the Ethereum L1 just like Optimism and Abritrum whilst still allowing DApps to be connected to 17 different EVM compatible layer-1 blockchains and Ethereum native layer-2’s such as Optimism and Arbitrum.

In Ethereum layer-2’s, EVM compatibility is arguably the most important aspect of the application level developer experience allowing the seamless porting of protocols and developer tooling. Synapse chain is completely EVM compatible. DApps that are inherently cross-chain require multiple protocol instances which has numerous pain points in terms of deployment and maintenance plus the fragmentation of liquidity which affects user experience. A single execution environment only requires developers to deploy a single protocol instance while still being connected to many different layer-1’s and layer-2’s. An example to illustrate this:

Take a derivative DEX such as Perpetual Protocol. Different protocol instances on each chain require a set of liquidity providers. Liquidity depth on Optimism may be much deeper than Avalanche for example. Avalanche traders will therefore incur more slippage and worse price execution due to the liquidity fragmentation. Therefore, instead of multiple protocol instances Perpetual Protocol could opt for a single instance on Synapse chain concentrating all liquidity providers whilst still accessing traders from 17 different chains using Synapse’s cross-chain messaging system.

Since Synapse Chain is a layer-2 the sequencer responsible for block construction will be initially centralised. However, over time the sequencer will begin to decentralise which will introduce delegated PoS utility to SYN holders to capture protocol inflation and potentially a portion of the fees from the layer-2 transactions. Beyond this the security model which Synapse uses for their cross-chain messaging will require a similar incentive structure to align the security of the chain which we will discuss more below.

Optimistic Message Verification

The optimistic message verification security model for a generalised messaging system was originally pioneered by Nomad, who unfortunately suffered an exploit draining almost $200m in crypto assets. Note this vulnerability was no fault of the security model but an error that marked a zero hash as a valid message allowing transactions to be copied and bridge assets to be drained. However, in terms of the security-latency trade-off the optimistic message verification model showed excellent promise in the construction of a generalised messaging system and has since been adopted by Synapse protocol in their new Synapse Chain architecture.

Since there is no such thing as a trustless bridge, the entities who validate cross-chain messages must be incentivised for honest behaviour, exactly how traditional proof-of-stake consensus works. Many bridge security exploits have resulted in M-N security models in which M participants were co-opted via social engineering or technical incompetency. There needs to exist a better security model where latency isn’t sacrificed to such a degree that it impacts an applications performance/user experience but maintains the highest level of security.

In the optimistic message verification system, a set of off-chain actors known as Watchers monitor cross-chain messages and flag potentially malicious or fraudulent messages. The security model derives its name exactly how optimistic rollups derived their name; cross-chain messages are optimistically assumed to be correct and its the watchers job to flag and prove that a message was malicious within the set finality period. Watchers are economically incentivised to behave honestly by requiring SYN to be bonded exactly like PoS consensus to which any malicious behaviour is economically penalised via slashing their staked capital. The security of optimistic messaging derives from the fact only one single honest actor is required for the system to work. In order to co-opt the network N participants need to collude instead of M participants in M-N security models. Therefore, the security model operates on a 1-of-N basis making it highly robust from a security perspective. The finality period is also substantially less than traditional optimistic rollups with a 20–45 minute finality period.

Summary

Multi-chain DApps in their current form are technically cumbersome and pose numerous user problems such as liquidity fragmentation. There will always be a trade-off between security and latency but the generalised messaging system that can maximise security and minimise latency will capture the largest ecosystem. Synapse protocol is positioned to be a leader in generalised messaging protocols and even in the optimistic rollup vertical competing with the likes of both Optimism and Arbitrum. The optimistic message verifications security model looks to be the best current model requiring only one single honest actor with a 0 minute finality period. We believe that Synapse Chain in the future will host a vibrant ecosystem of multi-chain DApps ranging from derivative DEXs to money markets to which value will accrue back to SYN holders who participate in the delegated proof-of-stake consensus mechanism.

LayerZero and Stargate Finance

LayerZero

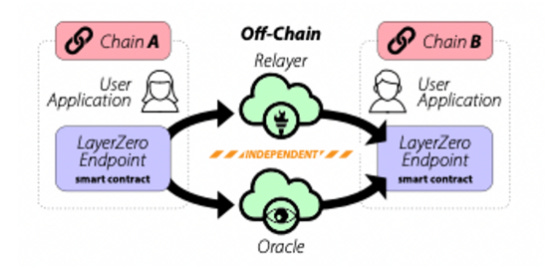

LayerZero is a generalised messaging system that facilitates the relay of arbitrary messaging from a source chain to a destination chain. The protocol has already established a vibrant application including a liquidity layer with Stargate Finance, a DEX with Trader Joe and money market protocols such as Radiant each leveraging LayerZero’s cross-chain messaging architecture. The architecture is different from the optimistic messaging system that we discussed above. The LayerZero protocol operates in the following manner:

Endpoints: Each chain integrated into the LayerZero network has a LayerZero endpoint. These endpoints allow users to send cross-chain messages via the LayerZero protocol guaranteeing delivery to the destination chain.

Oracle: The Oracle is responsible for ****reading a block header from the origin chain and sends it to the destination chain. LayerZero utilises Chainlink as its oracle provider being the industry standard oracle solution.

Relayer: The Relayer is responsible for fetching the proof for a specific transaction. DApps by default use the layerZero relayer but developers have the ability to build a separate relayer to ensure theres no collusion between the Oracle and Relayer.

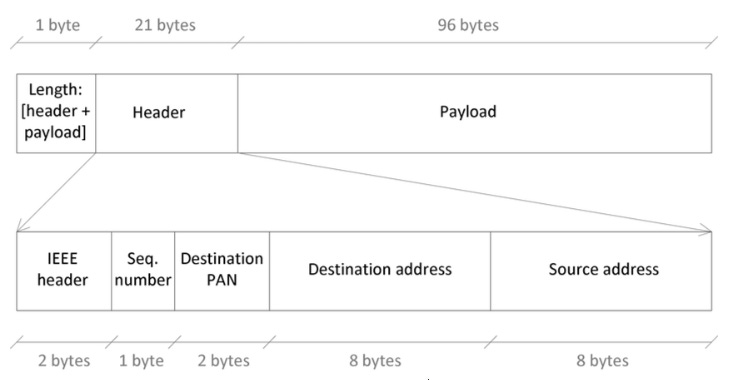

The messages sent from the source chain via the LayerZero protocol are only considered valid if the associated transaction is valid and has been committed on the origin chain. The messages are compromised of a unique transaction identifier, a global pointer to the destination chain, payload that contains the message a user wants to send to the destination chain and the relayer arguments outlining which relayer the message is to be sent using. In terms of developer integration, implementing the LayerZero is relatively simple:

// Function that sends a LayerZero message to a specific LayerZero endpoint

function send(

uint16 _dstChainId,

bytes calldata _remoteAndLocalAddresses,

bytes calldata _payload,

address payable _refundAddress,

address _zroPaymentAddress,

bytes calldata _adapterParams

) external payable;

// Example of calling the send() function

ILayerZeroEndpoint public endpoint;

bytes memory remoteAndLocalAddresses = abi.encodePacked(remoteAddress, localAddress);

// Enpoint calls send LayerZero send function with arguments.

endpoint.send{value:msg.value}(

10001, // destination LayerZero chainId

remoteAndLocalAddresses, // send to this address on the destination

bytes("hello"), // bytes payload

msg.sender, // refund address

address(0x0), // future parameter

bytes("") // adapterParams (see "Advanced Features")

);The process of a DApp receiving a message from the source chain has a similar process in which developers implement the lzRecieve() function that stores the payload of a message each with its unique counter. The simplicity in which LayerZero allows developers to integrate cross-chain message communication is what makes it such an attractive generalised messaging system that already hosts a vibrant ecosystem. We expect this trend for LayerZero to continue into the future.

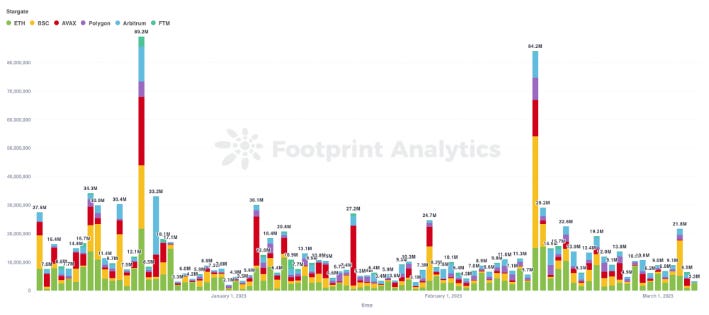

Stargate Finance

Stargate Finance is LayerZero’s primary DApp that acts as a liquidity layer facilitating the seamless bridging of native assets from a connected source chain to a destination chain. At this point in time there are 8 connected chains including Ethereum’s underlying layer-1, both Optimism and Arbitrum, as well as Avalanche, Fantom and Polygon. The protocol charges 6 bps per cross-chain swap to which 4 bps go to the protocol treasury, 1 bp goes to veSTG stakers and 1bp goes to the liquidity providers which are also incentivised via STG inflation rewards.

Stargate is focused on solving the bridging trilemma which discusses the inevitable trade-off’s between instant guaranteed finality, native assets and unified liquidity. To expand on this:

Instant Guaranteed Finality: When a user successfully commits a transaction on the source chain the desired asset will arrive on the destination chain.

Native Assets: Instead of using wrapped assets which requires users to perform additional operations on the destination chain. Native assets such as dollar bagged stablecoins or ETH can be seamlessly bridged from the source chain to the destination chain.

Unified Liquidity: To prevent liquidity fragmentation across chains a single unified liquidity pool for native assets is used that creates deeper liquidity and better price impact for cross-chain asset swaps of native assets.

LayerZero and Stargate show us that cross-chain messaging is not just limited to the migration of liquidity between chains. But that the total addressable market for generalised cross-chain messaging is much larger enabling a new vertical of natively cross-chain applications and is not limited to just the bridging of assets between segregated blockchain networks. Based on the first principle that DApps will seek cross-chain deployments to maximise user acquisition and revenue we can assume that generalised messaging systems will be the core bedrock for the future of multi-chain applications.

Summary

Bridges are a subset of the more broader generalised messaging thesis that is not just limited to a liquidity layer between blockchain networks, but is instead the foundational bedrock for the multi-chain paradigm and the inevitability of cross-chain DApps as outlined in the Interoperability thesis principle. Security for these protocols is the most important part to focus on as an investor given the history of bridging exploits. We believe that the optimistic message verification model most likely remains the best solution given the security-latency tradeoff. Additionally, in an Ethereum rollup centric roadmap with Optimistic rollups taking the forefront for scalability, bridges will play a vital role in capital flow for bypassing the 7-day finality period. Therefore, as Layer-2’s continue their climb we can expect bridging volumes to climb with them.

Both Synapse Protocol and LayerZero show excellent prospects in the generalised messaging infrastructure vertical and we believe both are set to capture immense upside with the majority of the market undervaluing how foundational the protocols are to the future of multi-chain DApps. We are incredibly excited to watch the Interoperability thesis come to light in the next adoption cycle.

Excellent but 2 questions:

What happens to synapse when CCIP emerges?

Despite synapse potential, So next cycle $ sees value in interoperability? Seems too technical for retail to understand, they prob go into dog coins or they want shiny new thing...where am I wrong?